We personalize your experience.

We use cookies in our website to ensure we give you the best experience, get to know our users and deliver better marketing. For this purpose, we may share the information collected with third parties. By clicking “Allow cookies” you give us your consent to use all cookies. If you prefer to manage your cookies click on the “Manage cookies” link below.

Use our resume examples to find out how to create your perfect resume. Our resume samples and guides will provide the tips and guidance you need.

Our customers have been hired by*:*Foot Note

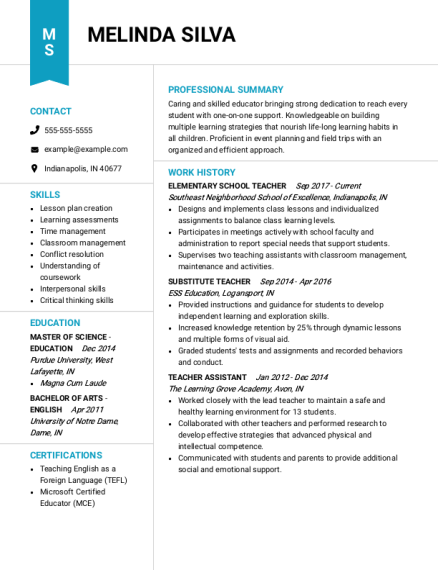

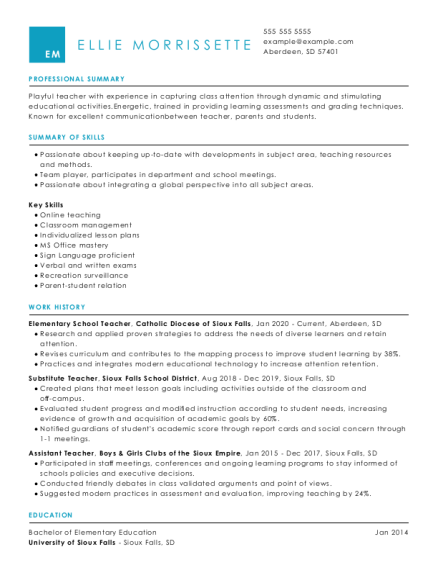

An effective teacher resume should show employers how you can help make a difference in students’ lives. This sample resume features 8-10 key skills that are well-rounded and give the hiring manager a good idea of everything the candidate can do.

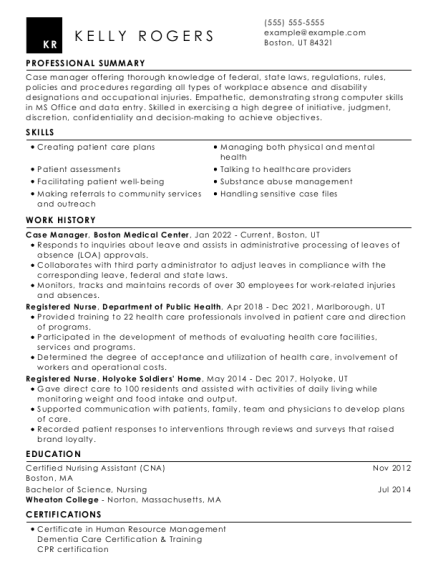

Show off your people skills and ability to handle high pressure environments using our registered nurse resume sample as a foundation to write your resume. This particular sample resume features relevant skills that provide a potential hiring manager more insight into what your capabilities are, making it a great source of inspiration for job seekers that have more than work experience to offer.

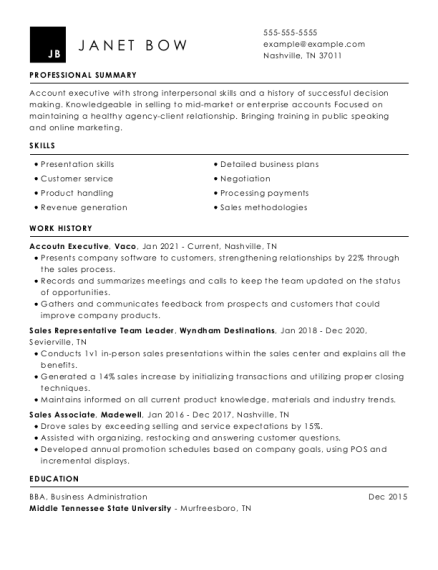

Use this sales associate example resume as a guide to see how you can highlight your work experience in a way that’s concise and straight to the point.

Review our library of resume examples to find the one that best fits your needs. You can then create your resume using our Resume Builder, or simply use the sample resume as inspiration.

Academic samples of resumes will show you how to highlight your educational background, research experience and academic achievements. From our student resume example to our Ph.D. resume sample, you can get an idea of how to tailor your resume for different academic positions.

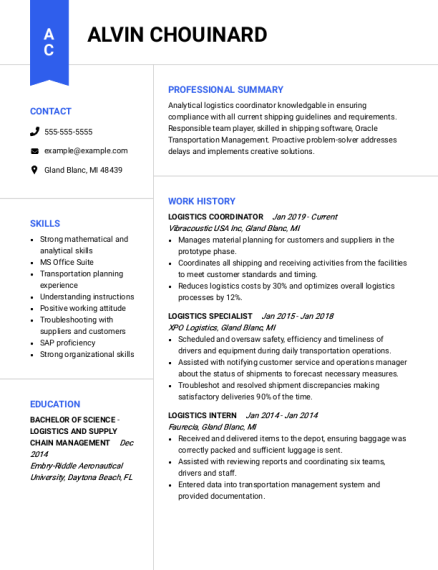

Craft a compelling business resume by leveraging our diverse range of examples of resumes as a foundation. Our extensive collection covers areas such as accounting, administration, finance and real estate. These resume examples will provide you with valuable insights and serve as inspiration for your own impressive resume in the field of business.

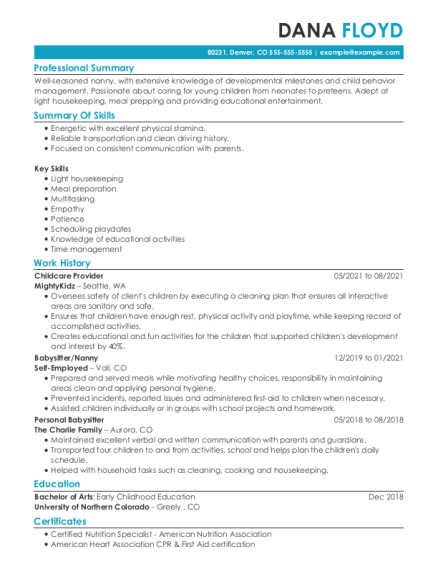

Create a strong resume by reviewing these caretaker resume samples to get guidance on how to highlight your professional skills and experience effectively.

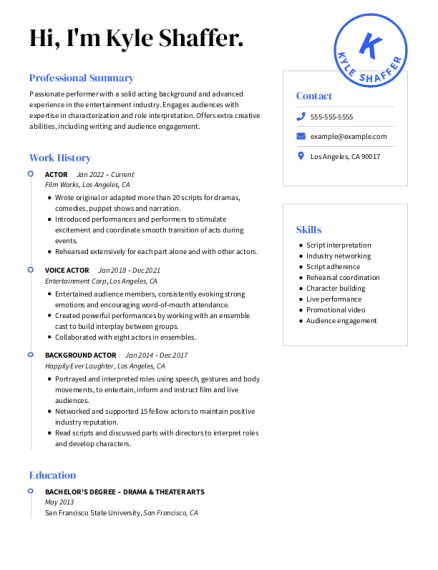

Use a creative resume example and template to create a standout creative resume. Whether you need a foundation for a marketing resume, or a design or writing resume sample, you’ll find the inspiration you need to make an eye-catching resume.

To create a strong education resume, review examples of resumes specific to your area of teaching, such as elementary education, secondary education or special education.

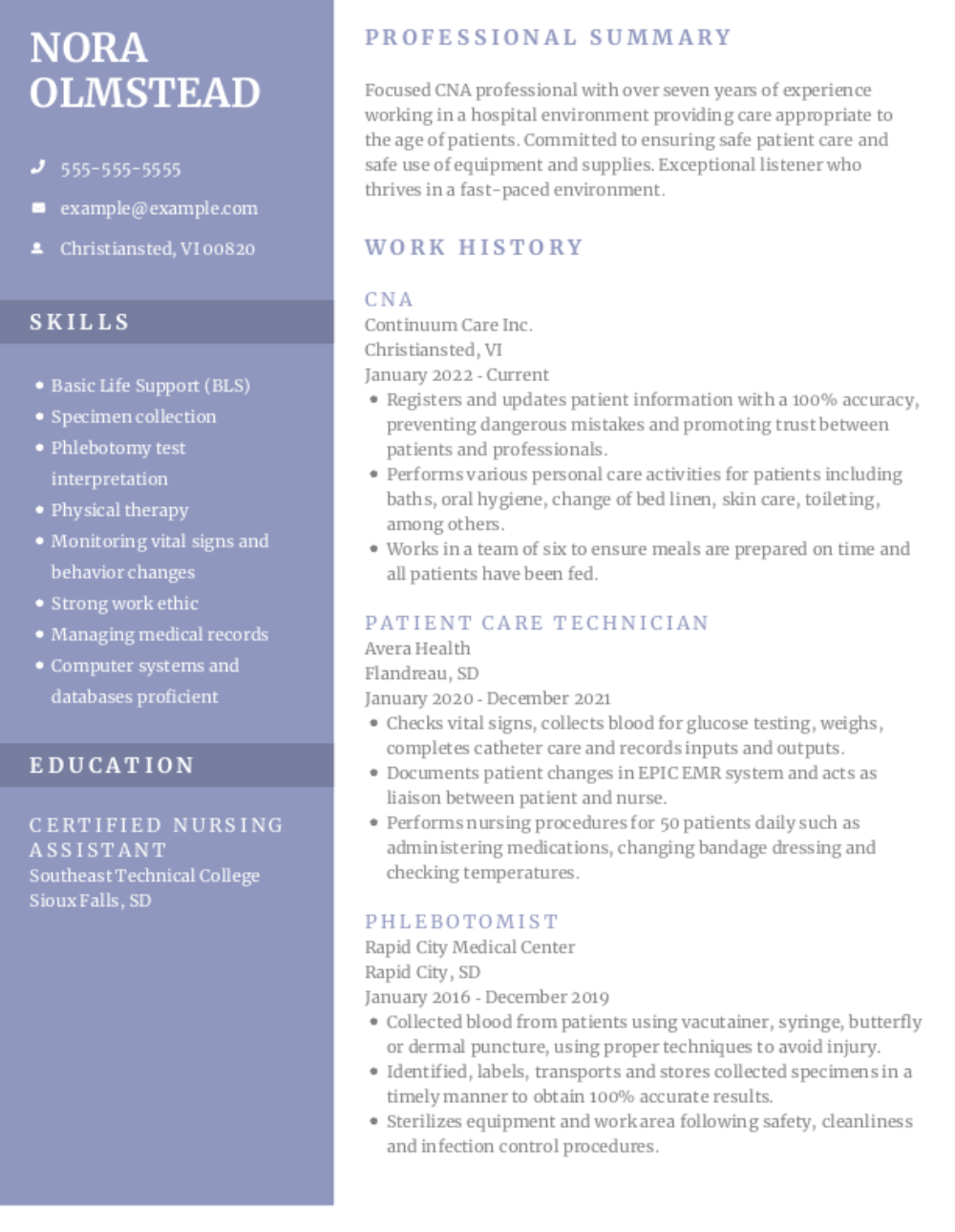

When creating a healthcare resume, reviewing relevant medical resume examples and nursing resume examples can show you how to present your experience and skills, as well as provide insight into the most effective resume format to use for your desired position.

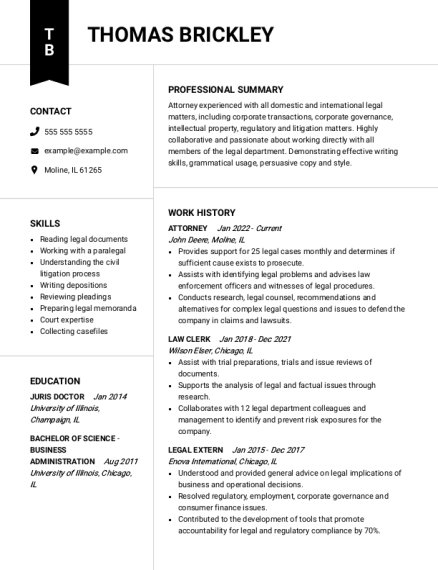

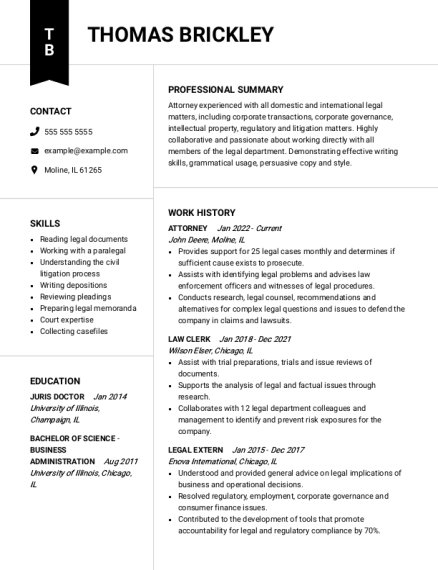

Legal resumes demonstrate a candidate's experience and legal skills. Reviewing professional resume examples specific to your legal field of interest will highlight experiences and skills you should consider for your resume, as well as the best layout to use.

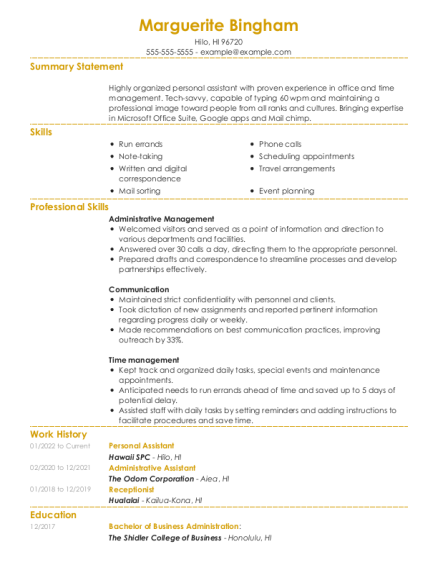

Our administrative sample resumes provide the perfect guide for your resume. Review some example resumes specific to your desired role, such as administrative assistant, receptionist or executive assistant.

Review an example resume free of charge and get ready to impress. Here, you can find everything from samples of a resume with no experience to construction resume examples and more.

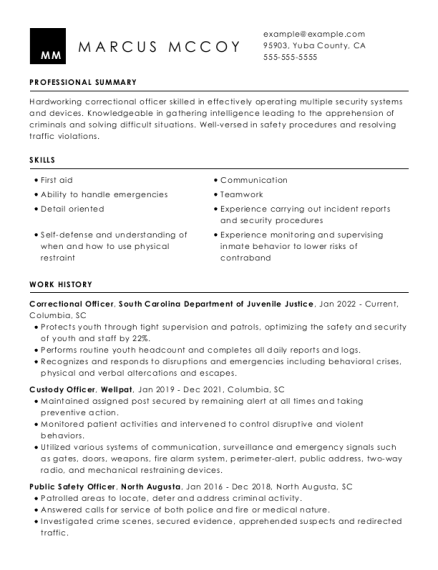

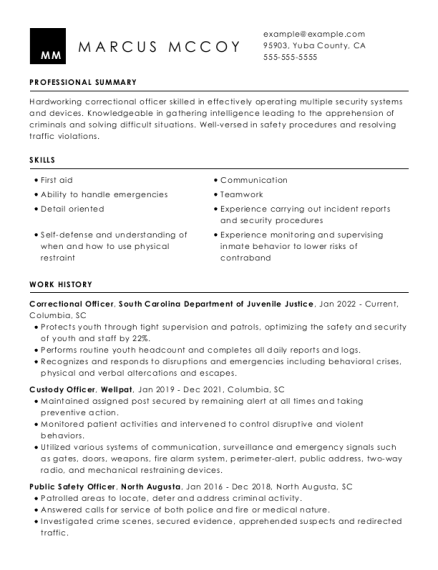

Our public safety resume samples showcase a candidate's experience in law enforcement or emergency response fields, as well as relevant skills such as crisis management and risk assessment. Reviewing sample resumes specific to the desired field can provide guidance on the most effective resume format and layout to use.

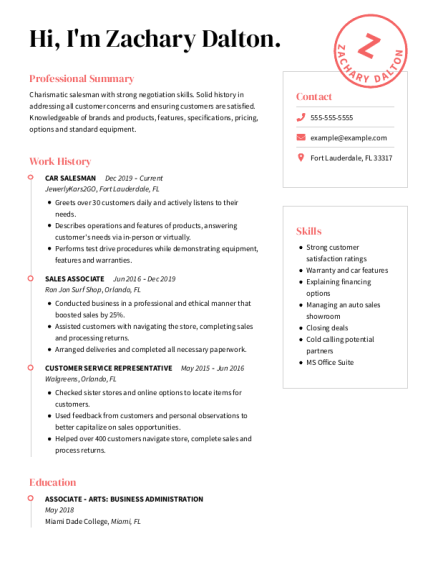

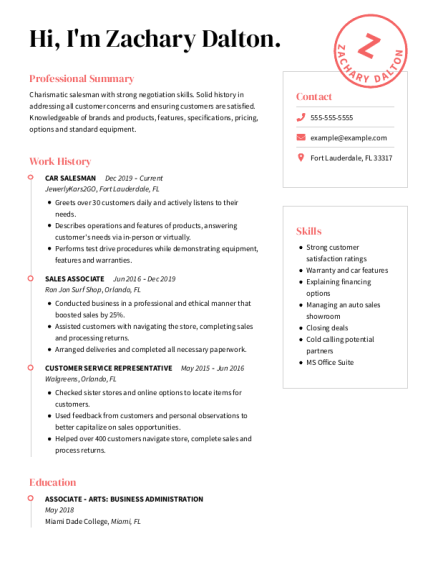

Sales resumes are designed to showcase a candidate's ability to drive revenue and build relationships with clients through effective communication, persuasion and negotiation. From customer service resume examples to food service resume examples, we have what you need to build a professional sales resume.

Technical and information technology resume examples demonstrate job seekers’ technical skills and experience. Reviewing sample resumes tailored to the desired field will provide you with insights on how to present your top experiences and skills in the most effective resume format.

You’ve completed your degree and you’ve got the skills: good communication, compliance knowledge, data analysis and attention to detail. But what else do you need for an accounting resume? Use our resume example to see what others are including in their resumes.

Organized multitaskers that know what’s needed before it becomes an active need as well as managing executive calendars, business ventures and the ins and outs of work tasks requires many skills. Find an administrative assistant example resume to help create yours, featuring the most sought-after skills.

The banking industry requires you to be good with numbers and great with people. Be inspired by banking resume samples from different positions and add the skills you need for an effective resume.

Interpersonal communication, marketing knowledge and sales experience are just some of the skills used in business. Learn about other qualifications, education and experiences successful job applicants use with these business resume samples.

For this industry, you need to know how to create with your hands, manage time to deliver a great product and communicate with coworkers and employees effectively. Check out other skills and certifications workers in the construction industry have on their resumes.

Your artistry and people skills in this field should bring out the best in anyone’s looks. Highlight your abilities and expertise by using a cosmetology sample resume to craft your own professional resume.

Customer service includes a multitude of in-demand careers that usually serve as the face of a company. Check out what others have added to their customer service resume, from multitasking, good listening skills and effective communication to marketing certifications.

A certification in food management, creative problem solving and active listening are some qualifications preferred by the food service industry. For more suggestions to create an impactful resume, use these food service example resumes.

Educators, whether in the classroom or in administration, are passionate about their students' progress. Their skill helps them succeed and their experience can set them apart. See our education sample resumes to help advance your career.

You’ve tinkered with electronics, cars, software and more. Why not tinker with your resume? Aided by these engineering resume samples, you can craft an effective resume highlighting the skills and experience needed for the position you want.

If you’re seeking to jump-start your legal career or be promoted to the next level, check out these legal industry example resumes. See what others have included in their legal resumes that could be missing from yours.

You can analyze data to create a great marketing plan, so take some time to analyze our marketing resume example. Find out what could be missing from yours and craft an effective resume in our builder.

Whether you work in medical records, as a coder, biller or office specialist, these medical sample resumes can help you find inspiration to update your own. Just find one suitable for the position you’re seeking and use it as a guideline for creating or updating your own or in our builder.

We’ve got the right nursing resume samples for in-demand careers. Whether you’re interested in working in a hospital, a home, as a traveling nurse or if you’re starting as a nurse assistant, find a nursing resume example that will help you create yours.

Maintaining the image of a company, finding good causes to contribute to and crafting the public face of a business requires many skills. See which ones others in your industry have included with the help of these public relations examples of resumes.

Finding a forever home, selling property and managing real estate requires a variety of skills. See which qualifications are missing from your resume with the help of these real estate samples of resumes.

If you’re in the science industry, either as an educator, coordinator, academic advisor or in some other capacity, you can find a science resume sample in the field and level you’re interested in and use it as a guide to create your own effective resume.

According to the Bureau of Labor Statistics, the security industry has an expected growth in jobs of 15% over the next decade. See how others in the industry are crafting their resume through our security resumes examples.

Your creative problem solving, willingness to try-and-fail and the ability to document for others make you a great software developer. If you’re seeking to advance your career, check out these software developer sample resumes and use them as a guide to craft a professional resume.

Balancing the law, family welfare and working with people of different backgrounds with empathy are just some of the skills used daily in social work. See what other skills, certifications and experiences others have used in these professional social work examples of resumes.

Remember to pair up your resume with an equally professional cover letter. Check out these cover letter examples and cover letter templates to find one that works for you and matches your resume layout.

Don’t waste time reading through resumes that have nothing to do with your target job. (After all, you wouldn’t submit the exact same resume to every job out there.) Avoid a “generic” resume that will only look like a cookie-cutter document to a hiring manager and use our resume examples to build a strong resume.

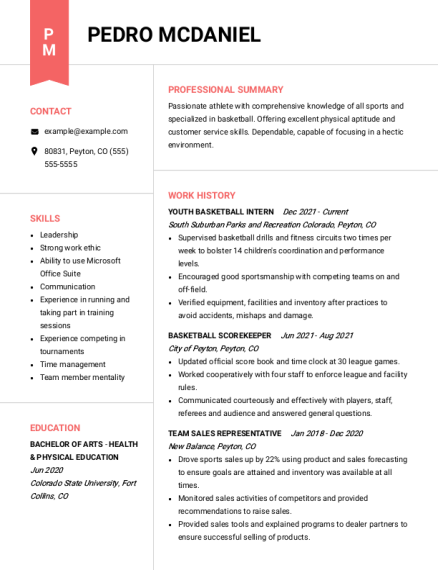

Our examples of resumes will show how you can build a unique resume no matter what position you want. These samples are created for specific jobs, featuring the important skills and attributes you should strive to include in your own resume. Use our resume samples as a guide to creating your own effective resume in our resume builder.

Knowing exactly what to write in a resume can be difficult, but our sample resumes can ease the burden. Each of our examples features job descriptions, action verbs and skills written by career experts that match what employers are looking for, presented in the words and terminology with which they are familiar.

Crafting a resume is easy with these resume samples – but you can get an extra boost with Resume Help’s Resume Builder. Use our sample resumes with our builder, and you’ll get expert suggestions that will make your resume stand out, creating an effective resume in a few steps. The builder is free to try!

It’s important to remember that when it comes to resumes, it’s all in the eye of the beholder – that is, the recruiter or hiring manager reading your resume. The resume samples on our website are vetted from a recruiter’s viewpoint, so you can be confident that you’re catching the eye of the person who really counts. We use job-specific keywords and feature skills and experiences that a resume for a job application should have.

You don’t need any design or layout experience to use our resume examples. Once you select the resume sample that fits the job you want, choose a resume template that matches your style and use the content in the example to help you craft a resume that presents your best, most relevant skills and work experience. If you use our Resume Builder, you can create, customize and save as many resumes as you need for different job opportunities.

If you don’t know much about writing a resume, that’s all the more reason to utilize a good resume example. With a resume example, you can take your resume from basic and bare-bones to exciting and informative, giving you your best shot for the job you want.

Have questions? We’re here to help.

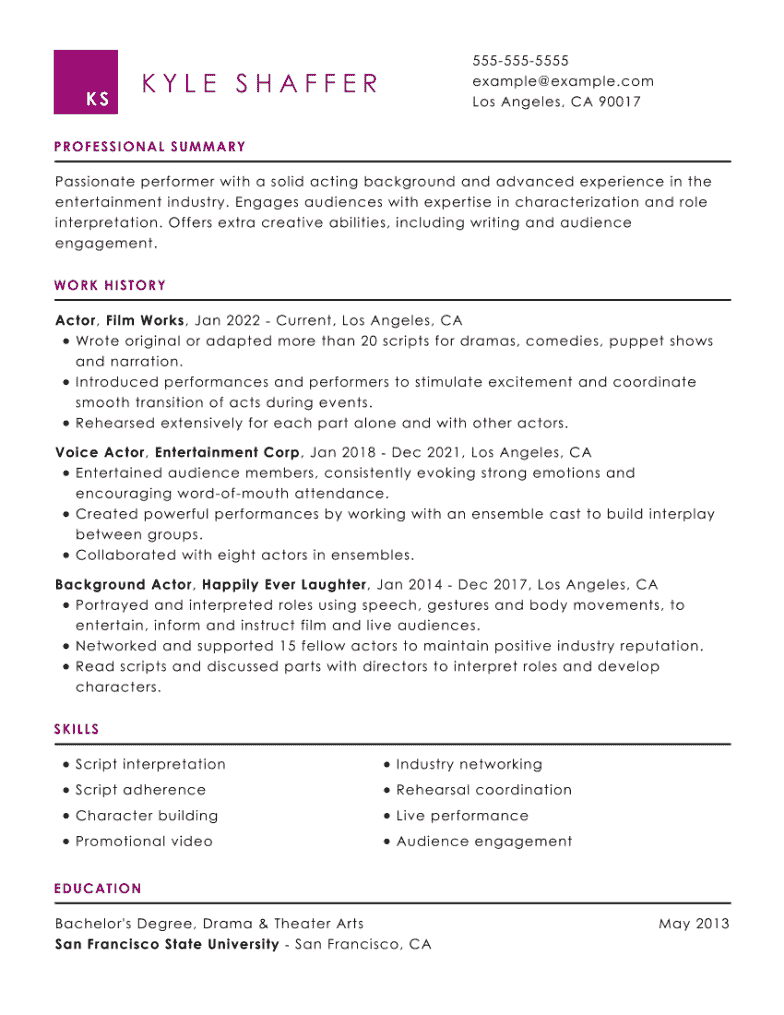

A resume example is a fully completed resume that shows you what your resume should look like. This may be a real person’s resume that was utilized to get a job or a resume created for a hypothetical job seeker. Either way, a resume sample should help you understand what hiring managers are looking for, pointing you in the right direction for putting together your own resume.

With over 10 million resumes produced, we’re experts when it comes to creating a resume. We’ve pulled together hundreds of resume samples organized by industry and position to help you create yours – everything from marketing resume examples to accounting resume examples and much more. You can use as much of a sample as you need or use it as inspiration for your own document.

Our samples will make it easier to complete your own and ensure you’re using the correct language to land that perfect job. Review our resume examples free of charge and put your best foot forward.

If you’ve never used resume samples before, you might wonder why they’re important. After all, why not just use a general resume template you can find online? Although a template can help you understand how a resume functions, generic resume templates don’t provide the same high-quality content that a job-specific resume example will.

Our examples are:

Think of an example as a guideline that will help you create your own resume. You’ll see what similar candidates feature on their resume as well as what the hiring managers are looking for. Follow these four steps to tailor our examples to match your needs.

You can choose from three major resume formats – the “best” one will be the one that best highlights your strengths:

The chronological format highlights your work history. This format lists your work history in reverse-chronological order, starting with your most recent job. It works best for individuals with over 10 years of experience.

The functional resume format focuses on skills rather than work history. It’s best for those with employment gaps or trying to manage a career change because it focuses on abilities you can bring to the table. However, many recruiters find this resume format challenging to read and analyze, which is why they often prefer the chronological or combination format.

The combination resume, also called the hybrid resume, blends the functional and chronological formats, presenting your skills first, followed by a brief work history. This allows you to highlight your skills while also giving recruiters an idea of how you’ve used these skills in past jobs. This format is also good for those looking for a career change.

All three resume formats can be appropriate depending on the situation, so take time to consider which one is right for your needs. Whatever format you choose, we have a multitude of resume examples and writing guides for hundreds of different industries and positions in all three formats. Use the resume template and samples that best fit your chosen approach.

Couldn't find the answer you're looking for?